UK interest rates seen hitting 6% after core inflation shock

City investors are ratching up their expectations for Bank of England interest rate rises, following the shock rise in core inflation.

The markets are pricing in that UK interest rates will hit 6% by December, up from 4.5% today.

Traders are concluding that the BoE will be very concerned that underlying inflation, and service sector inflation, both rose in May.

This is the huge problem for the Bank of England (and the rest of us)… ????

Core #inflation (excl. food and energy) is no longer just ‘sticky’ – it’s actually heading in the wrong direction pic.twitter.com/dGDsf3gRO0

— Julian Jessop (@julianHjessop) June 21, 2023

????????????After higher-than-expected CPI data was released, OIS futures priced in the Bank of England raising interest rates to 6% in early next year. #BOE #MM pic.twitter.com/jogdkM6CCD

— MacroMicro (@MacroMicroMe) June 21, 2023

The odds of a half-point increase tomorrow, when the Bank next sets interest rates, has now jumped to over 40%, according to the price of interest rate swaps.

Before the inflation data was released, such a 50-basis point hike tomorrow was seen as a 25% chance.

Market now firmly expects Bank of England rate to peak at 6% rather than 5.75%

— John Stepek (@John_Stepek) June 21, 2023

Jake Finney, economist at PwC says:

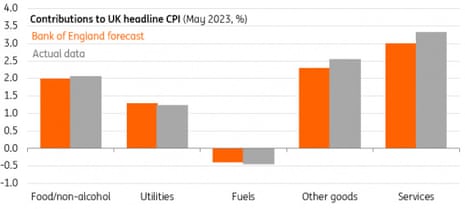

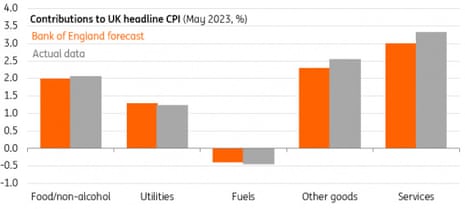

UK inflation has once again come in higher than expected at 8.7% in May. This is higher than the 8.5% consensus and the Bank of England’s forecast of 8.3% in May. More troublingly, core CPI – which is considered to be indicative of underlying inflation pressures – unexpectedly increased to 7.1%.

The primary culprit for the higher headline figure was services inflation, which increased from 6.9% to 7.4% due to upward pressure from cultural services. It now seems likely that services inflation will take longer to come down than the time it took to come up, especially with wage growth remaining strong.

Higher inflation means that the squeeze on household incomes isn’t over yet, despite strong wage growth. It also cements a rate hike from the Bank of England tomorrow and means an August rate hike is now more likely than not.

Key events

Today’s inflation figure of 8.7% is “a shocker”, says Professor Costas Milas of the University of Liverpool’s Management School.

He believes it will prompt the Bank of England (BoE) into raising interest rate by half a percentage point tomorrow, to 5%, telling us:

The BoE predicted, only last month, an inflation rate of 8.22% for the second quarter of 2023.

For this to materialize, inflation needs to increase by 7.3% in June. This huge drop from the current 8.7% rate is almost unlikely to happen.

To defend its credibility, I sense the MPC will most likely feel “obliged” to raise tomorrow it’s base rate by 0.5 percentage points and assess the very effect in August’s Monetary Policy Report (and next decision). There is no interest rate decision in July….

At 8.7%, inflation remains higher in the UK than in many other advanced economies.

In the eurozone, CPI inflation fell to 6.1% in May, down from 7.0% in April.

Within the bloc, French inflation dropped to 6% from 6.9%, while in Germany it dropped to 6.3% from 7.6%.

In the US, inflation dropped to 4% from 4.9% in April, meaning prices are rising just half as fast on that side of the Atlantic.

Increasingly worrying how inflation is haunting the UK while falling elsewhere.

Increasingly hard to blame the BoE given the extent to which other central banks also used QE during the pandemic. https://t.co/hOXTj8rtyl

— Julian Harris (@Hariboconomics) June 21, 2023

Price pressures in the UK are being fuelled by a jobs market that is struggling to recover from the Covid-19 pandemic, Brexit visa rules and the decision by many older workers to quit the employment scene.

My colleague Phillip Inman reports:

In France, the rate of worker participation is higher than before the pandemic. That is to say, a higher proportion of working age people have a job or have registered to work. In the UK, the participation rate has declined, driving up wages and maintaining the pressure on prices.

The UK also imports more than 50% of its food, mostly from the EU, which has proved to be badly affected by rising raw materials costs. Food prices have risen at more than 18% for most of the year, pushing the overall UK inflation rate above those of rival economies.

In a new blow to mortgage holders, the cost of UK government short-term borrowing has jumped this morning.

The yield, or interest rates, on two-year British government bonds has jumped as high as 5.1% – a new 15-year high – up from 4.93% last night.

Two-year bond yields are sensitive to interest rate speculation, and are used by lenders to price mortgage rates.

Economists: Expect another interest rate rise tomorrow

City economists say that another interest rate rise tomorrow is a done deal – the only question is whether the Bank of England plumps for a quarter-point rise in rates, to 4.75%, or goes big with a half-point rise to 5%.

The Bank has already raised interest rates 12 times since December 2021, but will not be happy that inflation is still so high.

Capital Economics are now predicting that the Bank will go for the half-point rise, to 5%, due to this morning’s inflation report. They cite the increase in core inflation, saying:

A lot of attention has focussed on the fact that inflation failed to fall in line with expectations last month and was instead unchanged at 8.7%. But the bigger concern in our view is that core inflation rose yet again, hitting a 31-year high of 7.1%.

This marks the UK out from other advanced economies, including the euro-zone and the US, where core inflation has started to fall. There are several factors at play, but an important one is that inflation appears to have infected the labour market and wage setting to a greater extent in the UK than elsewhere.

While tomorrow’s MPC meeting is finely balanced, we think that a 50bps increase in Bank rate is now slightly more likely than a 25bps. The consensus remains for a smaller increase, but the markets are pricing in a 50% chance of larger move. Accordingly, a failure to deliver could cause financial conditions to loosen and the pound to weaken, which is the last thing that policymakers at the Bank need right now.

Analysts at ING say the Bank of England faces a very difficult dilemma, but suspect rates won’t reach 6%, as the markets are now pricing in.

Headline inflation should come down more noticeably over the next couple of months, owing to some pretty hefty base effects. Last June saw a near 10% spike in petrol prices, whereas prices are currently falling, and of course in July we’ll see a material fall in household electricity/gas bills. Core inflation we think should come lower too, though to a much lesser degree and mainly because of further renewed downward pressure from certain goods categories.

Headline CPI, we think, will be just below 7% by July and around 4.5% by year-end. Core inflation will probably end the year above 5%.

All of this makes life even harder for the Bank of England. We think the bar for another 50bp hike is set pretty high, but a 25bp hike is basically guaranteed, as is another in August. But markets are now fully pricing a 6% peak for the Bank rate, which implies six more rate hikes from current levels. That seems excessive, and we suspect the Bank of England would privately agree.

Shares in housebuilders are falling in early trading in London.

Berkeley, Persimmon and Barratt Development are all down over 2%, among the biggest fallers on the FTSE 100 index.

That suggests traders are expecting further increases in UK interest rates, making mortgages more expensive and dampening demand for new homes.

Berkeley reported this morning that it is still seeing “good levels of enquiry for well-located homes built to a high standard of design and quality”. But it admitted that the housing market is “likely to lack urgency” until consumers have a better idea of how mortgage rates will change over the coming months.

There is a sliver of positive news in this morning’s data.

UK producers, such as factories, benefited from a drop in input costs last month, giving them breathing room to slow their price rises.

Producer input prices rose by 0.5% in the year to May, down from a rise of 4.2% in the year to April, thanks to a fall in crude oil costs.

And output price inflation – what is charged at the factory gate – rose by 2.9% in the year to May 2023, down from +5.2% in April.

On a monthly basis, producer input prices fell by 1.5% and output prices dropped by 0.5% in May.

In some good news, the cost of making stuff (including food costs) is easing sharply:

▶️Producer input prices up 0.5% in the year to May – lowest since Nov-20 & down from 4.2% in Apr.

▶️Factory gate prices up 2.9% in the year to May, lowest since Mar-21 & down from 5.2% in Apr. pic.twitter.com/9MohRToLP2

— Suren Thiru (@Suren_Thiru) June 21, 2023

Jeremy Hunt: Government must stick to its guns on inflation

Chancellor Jeremy Hunt has said the Government would “stick to its guns”, after inflation remained higher than hoped in May

He told broadcasters:

“Today’s figures strengthen the case for the Government to stick to its guns.

“No matter what the pressure from left, right or centre, we won’t be pushed off course.

“Because if we are going to help families, if we are going to relieve the pressure on people with mortgages, on businesses, we need to squeeze every last drop of high inflation out of the economy.”

Hunt has also called for patience, while rising interest rates have their effect on prices, saying:

“If you look at what’s happening in other countries, you can see that rises in interest rates do bring down inflation over time.

“That will happen here but we need to be patient, we need to stick to the course and then we’ll get to the other side.”

UK interest rates seen hitting 6% after core inflation shock

City investors are ratching up their expectations for Bank of England interest rate rises, following the shock rise in core inflation.

The markets are pricing in that UK interest rates will hit 6% by December, up from 4.5% today.

Traders are concluding that the BoE will be very concerned that underlying inflation, and service sector inflation, both rose in May.

This is the huge problem for the Bank of England (and the rest of us)… ????

Core #inflation (excl. food and energy) is no longer just ‘sticky’ – it’s actually heading in the wrong direction pic.twitter.com/dGDsf3gRO0

— Julian Jessop (@julianHjessop) June 21, 2023

????????????After higher-than-expected CPI data was released, OIS futures priced in the Bank of England raising interest rates to 6% in early next year. #BOE #MM pic.twitter.com/jogdkM6CCD

— MacroMicro (@MacroMicroMe) June 21, 2023

The odds of a half-point increase tomorrow, when the Bank next sets interest rates, has now jumped to over 40%, according to the price of interest rate swaps.

Before the inflation data was released, such a 50-basis point hike tomorrow was seen as a 25% chance.

Market now firmly expects Bank of England rate to peak at 6% rather than 5.75%

— John Stepek (@John_Stepek) June 21, 2023

Jake Finney, economist at PwC says:

UK inflation has once again come in higher than expected at 8.7% in May. This is higher than the 8.5% consensus and the Bank of England’s forecast of 8.3% in May. More troublingly, core CPI – which is considered to be indicative of underlying inflation pressures – unexpectedly increased to 7.1%.

The primary culprit for the higher headline figure was services inflation, which increased from 6.9% to 7.4% due to upward pressure from cultural services. It now seems likely that services inflation will take longer to come down than the time it took to come up, especially with wage growth remaining strong.

Higher inflation means that the squeeze on household incomes isn’t over yet, despite strong wage growth. It also cements a rate hike from the Bank of England tomorrow and means an August rate hike is now more likely than not.

Today’s inflation numbers are “truly unfortunate” and show the UK has a “serious inflation problem”, reports Melissa Davies, chief econonomist at Redburn.

Davies explains:

Inflation in the UK remains ‘hot’ across the board, with both consumer goods and services keeping up the pressure on prices.

One of the reasons US inflation is so much lower, for example, is that durable goods inflation has dropped to zero, but not so for the UK, where core goods and services CPI are both running in the high single-digits.

The lagged effects of energy price changes are worth around one percentage point on the headline rate now, which will largely come through in July, but this still leaves the economy with a serious inflation issue (the contribution from fuel prices is already negative).

Davies adds that there is “a long way to go to rein UK inflation to heel.”

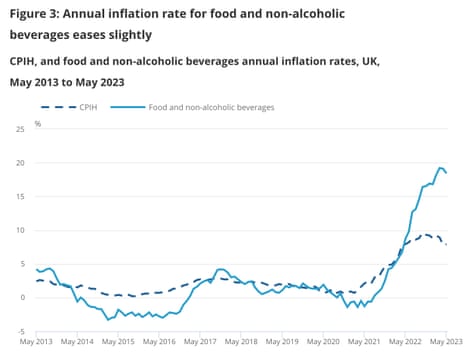

Food inflation falls, but still high

Food price inflation has eased in May, but products still cost much more than a year ago.

The inflation rate for food and non-alcoholic beverages dropped to 18.3% in the year to May, down from 19% in April.

During May alone, food and non-alcoholic drink prices rose by 0.9% between April and May 2023, compared with a larger 1.5% increase between the same two months a year ago.

Helen Dickinson, chief executive of the British Retail Consortium, says:

“It is a really positive sign that food inflation has fallen for the second consecutive month, the first time this has happened since the Ukraine war began.

While some prices continue to rise, we are now seeing regular news reports of falling prices on many essential products, such as loo rolls and vegetable oil. It has been good to see larger drops in inflation rates for flour, milk and eggs as retailers continue to invest heavily in lower prices for the future and locking the price of many essentials, helping the UK to deliver some of the cheapest groceries in Europe.

Elsewhere, consumers will find themselves under pressure from increased health and communication costs, as inflation rates in both categories rose in May.

ONS: Rising wages are fuelling services inflation

Grant Fitzner, the chief economist at the Office for National Statistics, says rising wages are fuelling the worrying increase in core inflation in May, to 7.1%.

Speaking on Radio 4’s Today programme, Fitzner confirms that headline inflation rate was unchanged in May at 8.7%, but adds:

In terms of what’s under the bonnet, something that may cause some concern is the continuing rise in core inflation.

That excludes food, energy, alcohol and tobacco, which has risen to 7.1%, the highest annual rate in core inflation since March 1992.

Fitzner explains that while goods inflation has been heading downwards, prices in the services sector – such as at cafes, restaurants and hotels – are rising at a faster pace.

That lifted services sector inflation to 7.4% (from 6.9% in April), which is the highest rate “in quite a while”.

This increase is probably driven at least in part by increases in wages, Fitzner suggests. [data last week showed regular pay increased by 7.2% in the three months to April, a 20-year high].

Join the exciting world of cryptocurrency trading with ByBit! As a new trader, you can benefit from a $10 bonus and up to $1,000 in rewards when you register using our referral link. With ByBit’s user-friendly platform and advanced trading tools, you can take advantage of cryptocurrency volatility and potentially make significant profits. Don’t miss this opportunity – sign up now and start trading!

Recent Comments