Shares in Rolls-Royce have risen to their highest since the start of the coronavirus pandemic after it surprised investors with a big jump in expected profits on the back of high demand in its jet engine and defence businesses.

The FTSE 100 engineering firm said its civil aerospace and defence units had reported higher sales and “cost efficiencies” that improved profitability, in an unscheduled trading update on Wednesday morning.

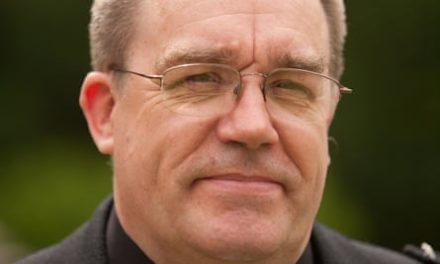

Rolls-Royce’s chief executive, Tufan Erginbilgic, took over at the start of the year with a mandate to raise its profits, which had lagged behind competitors before pandemic travel restrictions caused a dramatic slump in its earnings.

The company charges customers for the number of hours its jet engines run, which have rebounded as the travel industry recovers from the Covid crisis. It has also benefited from increased defence spending after Russia’s invasion of Ukraine.

Its share price rose by 19% in early trading on Wednesday, hitting a peak of nearly £1.91. That was the highest since 11 March 2023, when the prospect of bans on international travel caused aviation-related companies to plunge in value.

Erginbilgic, formerly a senior executive at the oil company BP, had in January warned that Rolls-Royce was on a “burning platform”, suggesting it needed to make rapid changes to stay in business in the long term. Speaking last month, he said the company had made “great progress” and said he was considering a return to the lucrative market for engines for smaller, single-aisle planes.

Yet the pace of the apparent financial turnaround has taken investors by surprise, and shares have almost doubled since the start of 2023. Chloe Lemarie, an analyst at Jefferies, an investment bank, highlighted higher sales volumes, cost efficiencies and higher prices in the Rolls-Royce civil aerospace and defence businesses, and added that profitability in its power systems business should also improve in the second half of the year.

Victoria Scholar, the head of investment at InteractiveInvestor, said: “Rolls-Royce shares have had an incredible run so far in 2023. Things couldn’t be going much better for Tufan Erginbilgic, who took the helm at the start of the year.

“His transformation plan across divisions is clearly bearing fruit with a sharp improvement in its operations, the post-Covid revival in flying hours, as well as increased defence spending on the back of the war in Ukraine.”

after newsletter promotion

Rolls-Royce raised its forecast for underlying operating profit to between £660m and £680m in the first half of its financial year, far above the £328m predicted on average by analysts. For the full year it said underlying operating profit would be between £1.2bn and £1.4bn up from less than £1bn before.

Erginbilgic said: “Our multi-year transformation programme has started well with progress already evident in our strong initial results and increased full-year guidance for 2023.

“There is much more to do to deliver better performance and to transform Rolls-Royce into a high-performing, competitive, resilient and growing business. Despite a challenging external environment, notably supply chain constraints, we are starting to see the early impact of our transformation in all our divisions. Better profit and cash generation reflects greater productivity, efficiency and improved commercial outcomes.”

Join the exciting world of cryptocurrency trading with ByBit! As a new trader, you can benefit from a $10 bonus and up to $1,000 in rewards when you register using our referral link. With ByBit’s user-friendly platform and advanced trading tools, you can take advantage of cryptocurrency volatility and potentially make significant profits. Don’t miss this opportunity – sign up now and start trading!

Recent Comments